First Time Home Buyers

Are you ready to buy a home in Halifax, Nova Scotia?

Purchasing a home is an exciting milestone that comes with many considerations. Whether you’re a first-time home buyer or an experienced homeowner, it is important to understand the process of purchasing a property in Nova Scotia. From mortgage pre-approval to understanding the benefits of buying versus renting, there are many factors to consider when buying your first home in Halifax. In this article, we will provide tips and advice on what you need to know when you are ready to buy your first home here in Nova Scotia.

Get Pre-Approved for a Mortgage

In order to purchase a home, it is necessary to get pre-approved for a mortgage. Before you start shopping for homes, you will need your credit score and income documented in order to evaluate your eligibility. We recommend that potential buyers take the pre-approval first before making any real estate purchases in Nova Scotia to know what you can actually afford as a mortgage. To find out more information on getting pre-approved, click here. Please note that Most mortgage lenders require a down payment between 5-20%. If you are able to pay more upfront, you may be eligible for lower interest rate loans, and shorter loan periods.

What are your MUST haves?

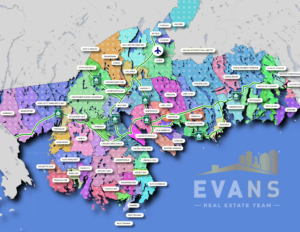

Once you have your pre-approval you can now start looking for homes in your price range! While looking for your first home there are a lot of things to think about. Are you looking for something turn-key or a fixer upper? How many bedrooms or bathrooms do you want? Do you want a fenced in yard for kids or pets? Is a garage a must have? Are there certain neighbourhoods that you want to be in? The Evans Real Estate Team suggest making a list of the top five must haves and top five must not haves. By doing that, we can help you with your house hunting search.

Choose a Realtor & Find Your First Home

Choose the best real estate sales representative to represent you in finding and purchasing your dream home and sign a Buyer Designated Brokerage Agreement to work together. It is important to trust your sales representative, as you will be spending a lot of time together and your sales representative will help you with one of the biggest financial commitments you will make. Here at the Evans Real Estate Team, we pride ourselves on being knowledgeable, friendly and use our strategies to make the whole real estate buying experience as stressed free as possible. Like our saying says “Our Strategies Are Your Solutions”. We are here for you throughout the process and beyond! You can learn more about us here

After a thorough understanding of your new home needs, we will set you up on a collab centre which will show you homes that meet most or all of your requirements. You can heart or thumbs down properties. We use your feedback to fine tune your search so you see more of the homes that are potential yes’ for you. We like to be one of the first people to view a home soon as soon as you see a property you are interested in we want to book a viewing. We will also help you find homes through:

- Online real estate sites including Paragon/MLS.

- For Sale or For Sale by Owners (FSBO’s) signs as you drive through neighbourhoods – we will make appointments to visit them.

- Open Houses & New home developments – accompanied by us.

Inspections

You found a home – congrats! Now we enter the pending period where you want to make sure there are no issues with the property. We will help you schedule a home inspector to conduct a thorough inspection of the property and if the report comes back with issues we will negotiate with the seller to complete any necessary repairs.

The reason to do a home inspection is to find if there are any:

- Structural Issues

- Mechanical Issues

- Electrical / Plumbing Issues

You want to do your due diligence before closing. We also recommend a septic inspection, water sample test, well inspection & water flow test (if you are not on municipal services) and a radon test (if the home resides in a Moderate – High Radon area)

What are your closing costs?

We recommend setting aside the following amounts of money:

- Relator Fees: $0 – Buyers do not pay realtor fees!

- Deed Transfer Tax: 1.5% of purchase price

- Lawyer Fees: $800 – $1,000

- Home Inspection Fee: $350 – $600 depending on type & size of property

- Septic Inspection, Well Inspection, Water Flow Test, Water Sample Test, Radon Test: $1,000 – $1,500 total.

Now What?

It’s time to celebrate! You found your first home and now you can settle in and enjoy this new chapter in your life!